The Definitive Guide to Feie Calculator

Table of ContentsThe Best Guide To Feie CalculatorExcitement About Feie CalculatorThe Ultimate Guide To Feie CalculatorGetting The Feie Calculator To WorkThe Facts About Feie Calculator UncoveredFeie Calculator Things To Know Before You Get ThisSome Ideas on Feie Calculator You Should Know

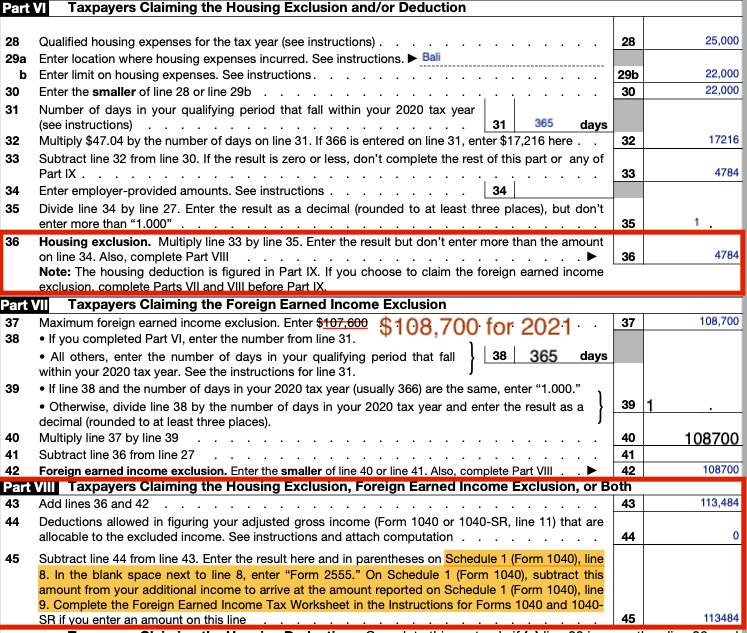

If he 'd often taken a trip, he would certainly rather complete Component III, providing the 12-month period he satisfied the Physical Existence Examination and his traveling background - Digital Nomad. Step 3: Coverage Foreign Income (Part IV): Mark made 4,500 per month (54,000 yearly). He enters this under "Foreign Earned Income." If his employer-provided housing, its value is likewise included.Mark determines the currency exchange rate (e.g., 1 EUR = 1.10 USD) and converts his wage (54,000 1.10 = $59,400). Considering that he stayed in Germany all year, the portion of time he stayed abroad during the tax is 100% and he goes into $59,400 as his FEIE. Mark reports complete earnings on his Form 1040 and goes into the FEIE as an unfavorable quantity on Schedule 1, Line 8d, decreasing his taxable income.

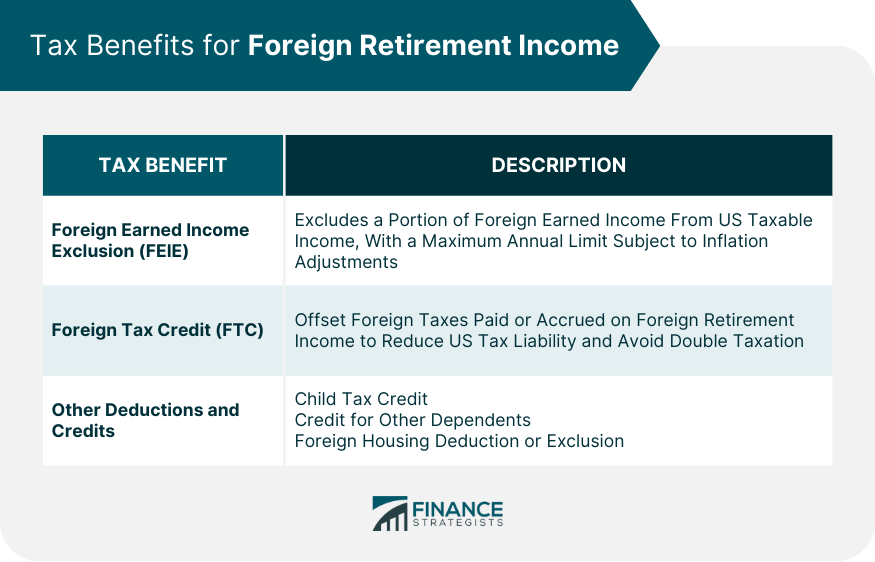

Selecting the FEIE when it's not the very best choice: The FEIE might not be perfect if you have a high unearned earnings, make greater than the exclusion limit, or reside in a high-tax nation where the Foreign Tax Obligation Credit Rating (FTC) might be much more valuable. The Foreign Tax Obligation Credit Report (FTC) is a tax decrease strategy frequently made use of combined with the FEIE.

The Only Guide to Feie Calculator

expats to counter their united state tax financial obligation with foreign revenue taxes paid on a dollar-for-dollar reduction basis. This implies that in high-tax nations, the FTC can usually get rid of united state tax obligation debt completely. The FTC has constraints on eligible taxes and the optimum insurance claim amount: Eligible tax obligations: Only income tax obligations (or taxes in lieu of revenue taxes) paid to foreign federal governments are qualified (Physical Presence Test for FEIE).

tax responsibility on your foreign revenue. If the international taxes you paid exceed this restriction, the excess international tax obligation can generally be continued for up to ten years or returned one year (through a modified return). Preserving accurate documents of international revenue and tax obligations paid is consequently important to determining the right FTC and keeping tax obligation compliance.

expatriates to minimize their tax obligation liabilities. If an U.S. taxpayer has $250,000 in foreign-earned income, they can omit up to $130,000 making use of the FEIE (2025 ). The remaining $120,000 may then undergo taxes, but the united state taxpayer can potentially use the Foreign Tax obligation Debt to offset the taxes paid to the foreign country.

Facts About Feie Calculator Revealed

He offered his U.S. home to develop his intent to live abroad completely and applied for a Mexican residency visa with his spouse to help satisfy the Bona Fide Residency Examination. Neil points out that purchasing residential property abroad can be challenging without first experiencing the place.

"We'll certainly be beyond that. Also if we come back to the United States for medical professional's visits or business phone calls, I question we'll spend greater than one month in the US in any provided 12-month duration." Neil highlights the value of strict tracking of U.S. visits. "It's something that people require to be actually diligent about," he says, and recommends expats to be mindful of common blog errors, such as overstaying in the united state

Neil takes care to stress to U.S. tax obligation authorities that "I'm not conducting any service in Illinois. It's simply a mailing address." Lewis Chessis is a tax obligation consultant on the Harness system with comprehensive experience assisting united state citizens navigate the often-confusing realm of global tax compliance. Among one of the most common misconceptions amongst U.S.

All About Feie Calculator

tax obligation return. "The Foreign Tax obligation Credit scores enables people functioning in high-tax countries like the UK to counter their U.S. tax obligation liability by the amount they have actually currently paid in taxes abroad," says Lewis. This makes certain that deportees are not tired two times on the exact same revenue. However, those in low- or no-tax nations, such as the UAE or Singapore, face extra obstacles.

The possibility of reduced living prices can be appealing, but it commonly comes with trade-offs that aren't immediately obvious - https://www.awwwards.com/feiecalcu/. Real estate, for instance, can be a lot more economical in some countries, yet this can imply endangering on infrastructure, security, or accessibility to dependable utilities and solutions. Cost-effective residential or commercial properties may be found in locations with inconsistent web, minimal mass transit, or unreliable medical care facilitiesfactors that can dramatically influence your everyday life

Below are some of one of the most often asked concerns regarding the FEIE and other exclusions The Foreign Earned Revenue Exclusion (FEIE) permits united state taxpayers to omit approximately $130,000 of foreign-earned income from federal earnings tax, lowering their U.S. tax responsibility. To get FEIE, you need to meet either the Physical Existence Examination (330 days abroad) or the Bona Fide Home Examination (verify your primary home in a foreign country for a whole tax year).

The Physical Presence Test needs you to be outside the U.S. for 330 days within a 12-month period. The Physical Visibility Test likewise requires U.S. taxpayers to have both an international revenue and a foreign tax obligation home. A tax home is defined as your prime area for business or employment, no matter your family members's residence. https://www.quora.com/profile/FEIE-Calculator.

Not known Facts About Feie Calculator

An earnings tax obligation treaty in between the U.S. and one more country can assist stop dual taxes. While the Foreign Earned Revenue Exclusion decreases taxed revenue, a treaty might provide fringe benefits for qualified taxpayers abroad. FBAR (Foreign Checking Account Record) is a needed declaring for U.S. people with over $10,000 in foreign economic accounts.

Neil Johnson, CERTIFIED PUBLIC ACCOUNTANT, is a tax consultant on the Harness system and the creator of The Tax obligation Guy. He has over thirty years of experience and now focuses on CFO solutions, equity payment, copyright tax, cannabis taxes and separation related tax/financial planning issues. He is a deportee based in Mexico.

The international earned income exemptions, in some cases referred to as the Sec. 911 exemptions, exclude tax obligation on earnings earned from functioning abroad.

Feie Calculator - The Facts

The tax obligation advantage excludes the earnings from tax at bottom tax obligation prices. Formerly, the exemptions "came off the top" reducing income subject to tax at the top tax rates.

These exclusions do not excuse the earnings from United States taxes but merely offer a tax obligation decrease. Keep in mind that a bachelor working abroad for all of 2025 who made concerning $145,000 without various other income will certainly have gross income minimized to absolutely no - efficiently the very same response as being "tax cost-free." The exemptions are calculated every day.

If you attended organization conferences or seminars in the United States while living abroad, income for those days can not be left out. For US tax it does not matter where you maintain your funds - you are taxable on your around the world earnings as a United States individual.